'21-’22 Fellow Mackenzie Halter’s Abolish Dept Dispute Tool featured in The Intercept

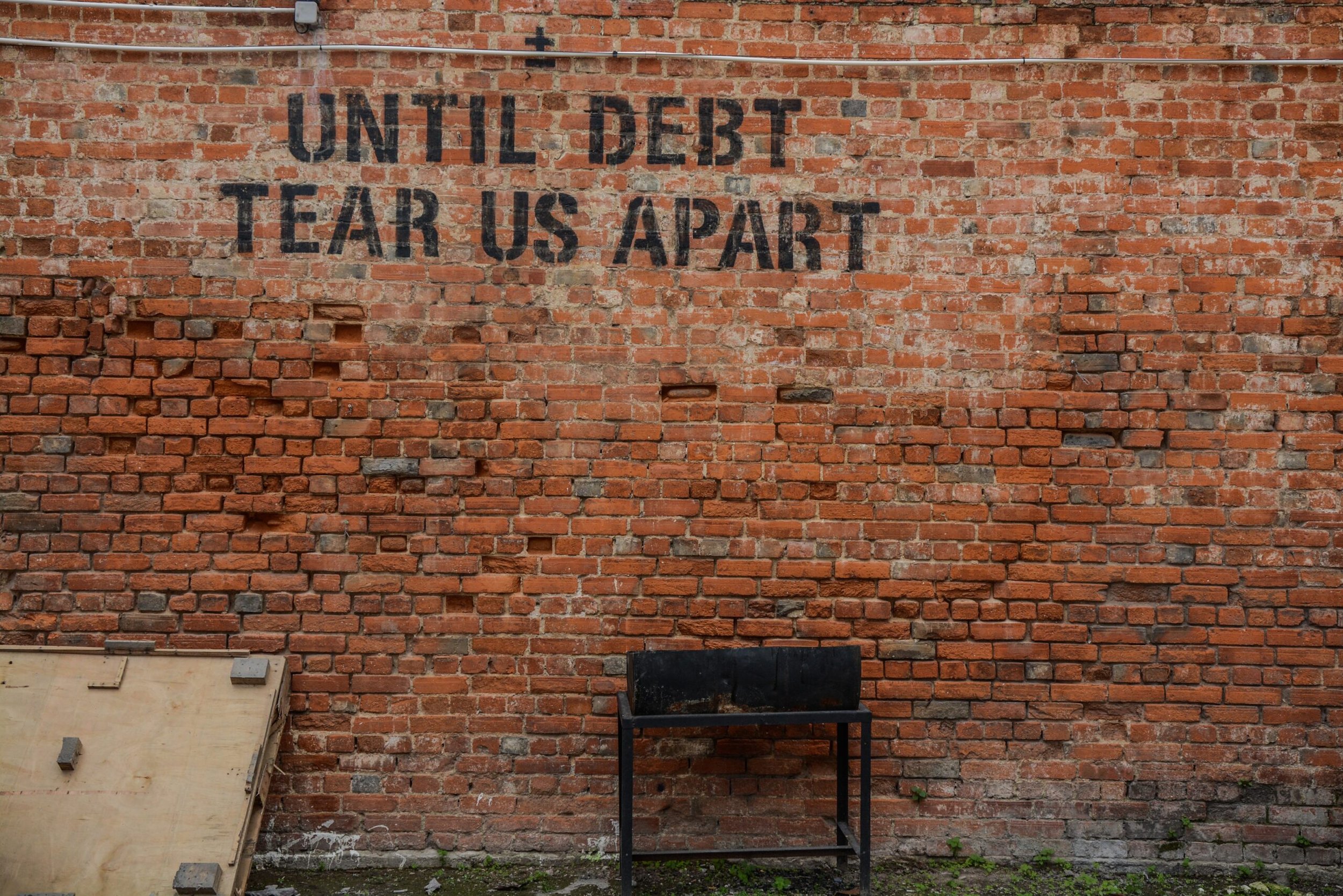

Stock image

Mackenzie Halter, a ‘20-’21 Justice Catalyst Fellow, is a fellow at The Debt Collective working on the Abolish Debt Dispute Tool, which allows cosigners on bail bond contracts in California to dispute bail debts using state consumer protection laws. Her fellowship project was discussed in a recent article featured in The Intercept. The full article, excerpted below, is available here:

****

The Rolling Jubilee Fund launched in 2012 as an offshoot of the Occupy Wall Street movement, initially focused on canceling medical, tuition, and credit card debt. The effort went dormant over the last five years as activists turned their sights to other projects they felt would bring about more systemic change. On Friday, the group announced a return to extinguishing debts outright, saying it had canceled $3.2 million in probation debt as “an act of solidarity” amid the Covid-19 pandemic. In the portfolio purchased by the group, the average debtor owed $159. The Rolling Jubilee Fund had been able to purchase all of it for just $97,922.

When the Debt Collective realized that buying and erasing debt wasn’t a sustainable strategy for change, it turned its focus toward building a national union of debtors. “We always knew there were limits to this tactic, but we’ve revived it because of the pandemic,” explained Astra Taylor, the group’s co-founder. “In that sense it’s an echo of 2008, we’re in another economic crisis, but it’s also different now. We can see that people were spending their stimulus checks on debt payments. We know that the non-mortgaged debts of retirees have doubled. We know that payday lenders made a killing over the last year. So we wanted to revive the jubilee for this moment, but a difference this time is also our abolishment of probation debt, which ties us into a whole new domain of criminal carceral debt.”

Canceling Carceral Debt

The $3.2 million in probate debt cancellation isn’t the only announcement the activists made on Friday. Activists also introduced a new online mutual aid tool that will help Californians cancel their bail bond debt. Using this so-called Abolish Bail Debt Tool, individuals who took out bail debt with co-signers will now be able to dispute the payments easily using state consumer protection law. Good data is hard to come by, but the Debt Collective estimates that more than 1 million people across California hold debt from bail bond contracts and that at least $500 million of that was obtained with a co-signer.

Hannah Appel, co-director of the Debt Collective, said the group’s bail tool came out of California organizing they got involved with in 2017, which was focused on other financial penalties from aggressive policing. “We would show up at other community organization meetings and, while there, offer advice on disputing household debt, and folks would say, ‘Yes, it’s great to be able to dispute all these debts that got worse while I was inside but I actually have debts from my incarceration itself. What can you do about that?’” recalled Appel. “And our answer at the time was nothing.”

The median bail bond in California is $50,000, which is five times higher than the national average. Since most people can’t afford that, they turn to private bail companies that typically charge 10 percent of the total bond amount in nonrefundable premiums and fees. While the California Supreme Court ruled earlier this year that conditioning freedom solely on whether an arrestee can afford bail is unconstitutional, the court’s decision does not affect the millions in bail debt still on the books.

The Debt Collective soon learned that Danica Rodarmel, then a fellow with the San Francisco chapter of the Lawyers’ Committee for Civil Rights Under Law, had developed a new legal application of California consumer protection law for these bail bond contracts. Her strategy, which she was testing out successfully with some clients, said that if one is a co-signer of a bail bond, then they should be treated as a credit lender under California consumer protection law. Among other things, California law requires co-signers to be provided with liability notices outlining their rights and obligations; Rodarmel noticed virtually no one was receiving these notices. Failure to give this notice entitles the co-signer to rescind (or cancel) the contract. While bail bond companies argue their contracts are not consumer credit contracts, so far the courts have disagreed.

With some funding from the San Francisco-based Future Justice Fund and the New York-based Justice Catalyst, the Debt Collective hired a legal fellow as well as a new carceral debt organizer and set out to make an online tool that leveraged Rodarmel’s application of the consumer protections, along with exploring other methods of using the laws to get carceral debt canceled.

Featured Fellow